Three Things You Can Do About Inflation

Inflation is on a lot of people’s minds right now.

And for a good reason.

While we tend to hear about inflation in terms of percent changes in government reports, chances are, you’ve likely experienced its real effects in everything from higher prices at the grocery store, gas pump, restaurants, and utility bills.

Prices change constantly, so why should you care about inflation now?

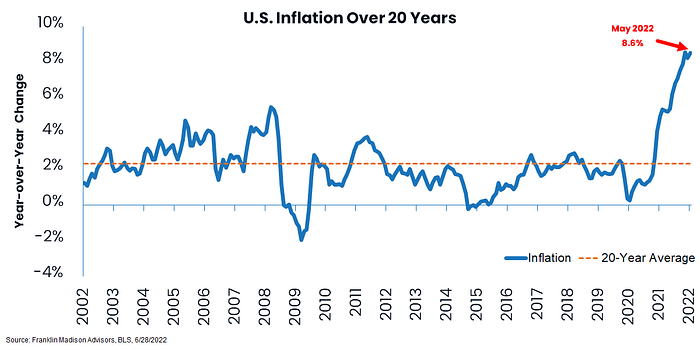

Well, other than the fact that inflation is at a 40-year high, it’s crucial to understand that when inflation stays high for a long time, it can potentially erode your ability to secure your future financial independence goals if you do nothing to prepare for it today.

What is inflation?

So, what is inflation? Simply put, inflation measures the rate at which prices change for goods and services you spend money on.

For example, if a pound of apples costs $1.05 today, when it was $1.00 twelve months ago, we can say that inflation has caused the price of apples to change by 5% over the past year.

Inflation is the rate of change, or speed, at which prices rise over time.

Whether you’re aware of it or not, inflation is always around. The price you pay for the things you need or want is constantly in flux. It can rise and fall daily, weekly, or monthly.

It’s like a car traveling down a highway.

Sometimes, inflation moves along steadily for months or years, like it’s on cruise control traveling at the highway speed limit. It can also suddenly speed up over days and weeks when something causes the gas pedal to hammer down.

What truly makes it a matter of concern now is how quickly inflation has sped up and how long it has remained in high gear.

How does inflation affect purchasing power?

Inflation matters because the longer it remains in high gear, the fewer goods or services your money will buy tomorrow.

Economists call this declining purchasing power.

For example, a dollar in the late 1990’s purchased one gallon of gasoline. Today, with gas prices around $5.00 per gallon, a dollar today has a fifth of the purchasing power it did over two decades ago!

A dollar is still a dollar, but it doesn’t go as far as it used to. At least for gasoline.

And when inflation takes off, you need more dollars to buy the same product compared to a month or year ago.

That’s why if you’re setting money aside for a big-ticket purchase or plan to live off your savings sometime in the future, you need to be able to anticipate rising prices.

Indeed, understanding purchasing power is essential whether you’re socking money away in a 401k to retire later in life or dependent on your savings now to cover retirement living expenses.

When inflation goes up, and purchasing power goes down, you’ll likely need to either save more money today, spend less in the future or do a bit of both. Otherwise, you could find your financial independence plans falling short.

What causes inflation to speed up?

Just like a car needs gas to power its engine and a driver to raise or lower their foot on the gas pedal, no one factor causes inflation to accelerate or decelerate.

Inflation is an interplay between supply (amount of gas in the tank) and demand (driver’s willingness to push down on the accelerator).

A full gas tank (supply) won’t make a car go fast with a cautious driver (demand) at the wheel.

Likewise, an aggressive driver can only go so far with fumes in the tank.

Let’s look at gasoline prices as an example. While some may argue that high prices at the pump are related to oil company profits, there’s more at play than pure greed.

From a supply perspective, the fact is that economic sanctions on Russia has led to oil shortages in the West.

At the same time, key oil refiners have shut down because of fires, needed repairs, or maintenance.

From a demand perspective, summer is the travel season. And as more cars get out on the road and air travel picks up, so does oil usage.

When supply is limited, and demand is high, prices tend to go up.

Buying a house is another example. Demand for new homes increased nationally during the pandemic as individuals moved to the suburbs to work from home.

It typically takes about a year or so to build a new home, making supply an issue when thousands of individuals are looking to buy a home simultaneously.

Again, when demand is high, and supply is limited, prices tend to go up.

What role does government money play in inflation?

Now, some people will blame the government for today’s high prices.

They’ll argue that if the Federal Reserve (Fed) hadn’t increased the money supply by printing trillions of dollars, or if it had raised rates sooner and the Treasury didn’t send out stimulus checks, we wouldn’t be dealing with high rates of inflation today.

To a certain extent, this is a valid argument.

Easy central bank policies arguably made it easier for banks to lend money, thus increasing demand from individuals willing and able to make large expenditures, like a new home or car.

Stimulus checks also made it easier for people to purchase goods or services they otherwise may not have needed during the pandemic, thus increasing demand at a time when economic lockdowns constrained global supply chains.

While this argument makes for a simple explanation, the truth is that the story is much more nuanced than can be explained by any one government policy.

That’s because the rise in food and energy prices today arguably has less to do with interest rates or government stimulus than it has to do with supply. While government policies have added to the demand side of the equation, the supply of raw materials and finished goods sourced from around the world is still in short supply.

It’s not just the government’s fault. To be sure, today, we’re dealing with a perfect storm of artificially too much money chasing artificially too few goods.

Who is going to stop inflation?

So, if inflation is seemingly speeding out of control, can’t someone stop it? The truth is, there’s only so much the government can do to halt inflation.

The Federal Reserve has raised its policy rate in a bid to slow down demand by making money more expensive to borrow and thus slowing the economy. But with war raging in Ukraine, ongoing Covid lockdowns in China, and other challenges, supply-side challenges likely will keep inflation elevated until those issues are resolved.

Fortunately, some businesses have raised wages to help workers offset higher living costs. However, most firms are not entirely altruistic, making up for higher wages by raising the price of their goods and services. This behavior could introduce an entirely new complexity to the inflation discussion. But, that’s a topic for another day.

Three things you can do about inflation

For now, inflation matters because it can affect your ability to maintain your standard of living now and into the future.

There’s not a lot we can do to affect the declining purchasing power of a dollar. However, you can mitigate its effects by:

1) holding just enough cash to help you sleep well at night,

2) putting excess cash to work in assets that move with inflation and

3) ensuring that you’re saving and growing enough money today to make up for a declining purchasing power in the future.

Hold just enough cash to sleep well at night

Setting cash aside during this time of economic uncertainty is essential to weathering a financial setback.

However, keeping too much cash on hand could leave you with a reduced purchasing power of your savings.

For example, let’s assume that you have $10,000 in a savings account that pays you interest of 1.00% per year. We’ll also assume that inflation averages 5.00% over the year.

How much purchasing power do you have at the end of the year? If you said $10,100 you’d be wrong.

While you earned $100 in interest, inflation reduced your purchasing power by $500, with inflation running at 5% during the year.

That’s why if you want to preserve the inflation-adjusted value of your savings, you’ll need to put it to work in assets that can protect your purchasing power.

Put your money to work in productive assets

Where else can you put your money if a savings account alone won’t protect against inflation? Consider your investments.

A diversified investment portfolio has historically been shown to be a hedge against inflation. Why?

Well, a key reason being is that the price paid for a stock today is often in anticipation of the underlying company’s future earnings potential. And with firms increasingly passing rising costs on to consumers, corporate earnings have the potential to rise with inflation over the long term.

At the same time, bondholders demand a return on their investment that will compensate them for their time, investment risk, and inflation.

While stocks and bonds offer a degree of inflation protection, consider holding a mix of these assets in a diversified portfolio to reduce investment risk.

Ensure that you’re saving enough to account for inflation

Finally, to our earlier point, inflation could leave your retirement savings goals falling short if not adequately accounted for. Indeed, if you want to secure your future financial independence when inflation is on the rise, you’ll likely need to evaluate whether you need to save more money, reduce your spending or do a little of both.

Let’s look at an example of how higher than expected inflation could alter the size of your retirement savings nest egg:

We’ll start with a base set of assumptions that at retirement, you’ll need roughly $50,000 per year to cover living expenses for the next 30 years. We further assume 2.0% average inflation and 5.5% average portfolio returns throughout retirement. At this rate, you’ll likely need to have saved one million dollars to cover your costs.

What happens if inflation comes in faster than 2.0%? Well, if inflation turned out to average 4.0% instead of 2.0% over your 30 years in retirement, your million-dollar nest egg could go to zero in just over twenty years instead of thirty years.

To overcome this shortfall, you’d likely need to save an extra $280,000 before retiring, reduce your retirement spending by $10,000 annually or delay retiring by six years.

That’s why periodically revisiting your financial plan and clearly understanding the effects of inflation on your expected future income need is essential to maintaining your standard of living and not running out of money in retirement.

Make no mistake, inflation can be a serious threat to your financial independence plans as it reduces the purchasing power of your savings.

Understanding the effects of rising inflation, putting your money to work in productive investments, and formulating a game plan to address declining purchasing power is essential to securing financial independence.

If you do nothing to mitigate this inflation threat, you could find your savings falling short of your desired standard of living later in life.