Trump Wins: What it Means for Your Money

We are likely entering a period of familiar uncertainty. Former President Donald Trump’s victory in Wisconsin early this morning clinched his victory and set the stage for a second term as the country’s president.

Market Implications

So, what does this mean for the markets, the economy, and your money? Well, as we pointed out in last month’s note heading into this week’s election, long-term investment data since 1953 shows that markets tend to grow irrespective of the sitting president’s party, with a $10,000 investment growing to over $2.1 million if invested continuously, compared to much lower returns if one invested only when Republican or Democratic administrations were in office.

This analysis highlights the benefit of sticking to a disciplined, long-term investment strategy instead of trying to time investments based on political cycles.

Economic Implications

Now, with respect to Trump’s second term, the effects of his economic policies could have long-term implications on your savings and spending decisions, given the potential for higher inflation in the coming years and higher taxes once he’s out of office.

How so?

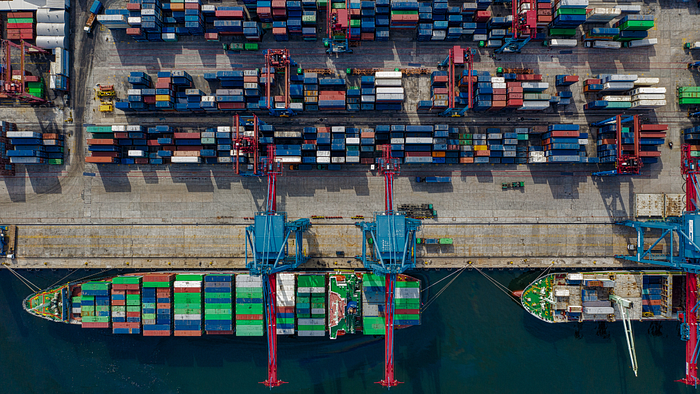

First, Trump vowed to renew his trade war with China and begin imposing tariffs shortly after taking office. Although often discussed in geopolitical terms, tariffs on China’s exports ultimately function as taxes on US consumers, which can lead to higher prices for goods consumed.

Effects of Tax Cuts

Second, Trump has proposed a host of tax cuts, including extending the 2017 Tax Cuts and Jobs Act (TCJA), eliminating income taxes on Social Security benefits, and reducing corporate tax rates.

Tax cuts provide extra disposable income for households. And when people have more money to spend, consumer demand for goods and services typically increases.

If this increased demand outpaces the economy’s ability to supply these goods and services, it can lead to higher prices and contribute to inflation. This point is crucial because a combination of rising import costs, fiscal stimulus, and easy money policies from the Federal Reserve could stoke the embers of inflation.

Higher Taxes Down the Road

Finally, all these tax cuts need to be paid somehow.

As it stands, the US government is spending more than it brings in by the tune of $1.8 trillion in 2024. According to a study by Wharton, this deficit could balloon to $5.8 trillion over the next ten years.

And so, while spending cuts are one way to tackle future deficits, policymakers will likely find ways to raise taxes down the road to cover these debts.

The Big Takeaway

We are headed into a period of familiar uncertainty as it relates to economic policy.

So then, proactive financial planning is prudent now more than ever because higher inflation and higher taxes later are likely a reality we’ll all face.

Loose fiscal and monetary policy, along with a renewed trade war, could lead to higher levels of inflation and a rising cost of living over the long term.

At the same time, ballooning government deficits cannot be ignored indefinitely, so spending cuts and higher taxes will be necessary to address the current plight.

Now’s the Time to Reevaluate Your Financial Plan

Therefore, reevaluating potentially overly optimistic inflation assumptions in your retirement plan could help you mitigate the effects of a rising cost of living and avoid savings/spending misalignment down the road.

At the same time, tax planning is essential now more than ever because regardless of which tax bracket you’re in now, there’s a good chance that years from now, your retirement distributions could be facing higher tax rates.

That’s why, while your portfolio may grow steadily in this changing political environment, now’s the time to begin planning for higher costs and evaluating strategies to keep more of your savings when it’s time to take distributions.

As we navigate this period of economic uncertainty, it’s crucial to actively review and adjust your financial plan. Doing so not only prepares you for potential inflation and tax changes but also positions your wealth to capitalize on opportunities that arise during fluctuating economic cycles.