What’s the best way to protect your hard-earned wealth?

What’s the best way to protect your hard-earned wealth? That’s the million-dollar question that’s on a lot of people’s minds right now. The fact is that the coronavirus has demonstrated in absolute terms how an unexpected event can quickly take away your earnings ability and deplete your life savings.

Events surrounding the coronavirus have also demonstrated how life’s surprises can come at you from all directions. And when they do, your ability to build enduring wealth can evaporate in the blink of an eye. So how can you protect your hard-earned wealth today?

Well, we believe that one way to prepare for life’s unexpected events is to incorporate a disciplined risk management process into your wealth management framework. This involves identifying outstanding risks, using tools to mitigate these threats and monitor for evolving challenges to your wealth.

Risks to Creating, Growing and Preserving Enduring Wealth

Before we dive into our discussion on the methods you can use to protect your wealth, let’s take a closer look at some of the ways that risks may come your way.

Risk — a situation involving exposure or danger

The word “risk” can mean many things to many people, so we’ll frame our discussion on the topic within the context of our wealth management framework. As you’ll recall from our previous reports, our wealth management framework focuses on the actions you need to take today to build enduring wealth over time.

This includes: 1) being intentional and efficient with your time and resources, 2) making your money work for you and 3) the topic of today’s discussion: taking steps necessary to protect your hard-earned money from both expected and unexpected events.

Indeed, the wealth management framework is just one tool you can use to build wealth. But the reason we believe that it’s important is that it’s a disciplined process that can help you create, grow, and preserve financial wealth for the long-term.

Being Risk Aware: Creating Wealth

The aim of our wealth creation process centers on steps necessary to generate a productive source of financial savings. These actions include 1) being intentional with your money 2) maximizing your value to others and 3) optimizing your net worth.

Your goals during this time should be to hone your innate talents and abilities and leverage a systematic, disciplined process to build a solid financial base. Now, what would you do if your ability to create wealth became impaired? For some people, COVID-19 has done just that.

Many of us spend a lot of time thinking about various ways we can get ahead and produce results. And often we do this without really giving much thought to what could derail our efforts or take us out of the game completely.

As of this recording, Coronavirus infections continue to rise across the US. And there’s no doubt that the outbreak has impacted many lives in many different ways. The current events also illustrate the kind of risk awareness you must have if your goal is to produce enduring wealth during the creation process.

More specifically at this stage, your awareness should focus on identifying risks that can impede your ability to earn an income and address hazards that can impair the value of assets you use to grow wealth. So, what are some of these risks?

Well, we’re talking about events that could lead to short term or long-term disability, property damage, lawsuits, and in some cases, death. We’ll talk about measures you can take to protect yourself against such events in just a moment. But the point here is that you need to develop an awareness of the risks that could derail your ability to create wealth before they even happen.

Being Risk Aware: Growing Wealth

Sustaining your disciplined wealth creation habits and then using 1) your base of savings, 2) a rate of return, and 3) some time to make your money work for you are the goals of the growing wealth process.

The obvious risks to growing wealth are financial market volatility and other losses related to investing. With that said, there more insidious threats working against you as you’re growing your wealth.

These are menaces waiting to separate you from your hard-earned money — one basis point at a time. These factors include excess fees eating into your investment rate of return and the IRS taking a bigger bite of your earnings. So, what exactly do we mean here?

Well, here are a couple of examples. First, let’s think about fees charged on investment products for a moment. Did you know that a one-percent investment management fee difference can lead to more than $400,000 in wealth forgone on a million dollars invested over 20 years?

What about taxes? As it relates to investing, you could have income on the same two savings vehicles taxed at many different rates simply based on the structure of one savings vehicle versus another.

The takeaway here is that if you’re not careful with how you put your money to work, you may be growing your money but at a much slower rate than you otherwise could during your growth phase.

Being Risk Aware: Preserving Wealth

Seeing through important life goals like retirement or even leaving behind a legacy is the aim of the wealth preservation process. During this time, you’ll need to ensure that the money that you’ve spent time accumulating and growing is still around to pay for your important life goals years from now.

And not only that, but that there’s enough left over to pass along to people or charities closest to your heart if that’s important to you. The risk here is that there won’t be enough money to meet your retirement needs or the needs of your loved ones.

This can occur, for example, when financial markets experience a sharp sell-off just as you’re preparing to enter retirement. There’s no question, this year’s financial market volatility has acutely illustrated how a sudden and deep pullback in the markets can derail even the best-laid retirement plans.

Another risk to wealth longevity is having your purchasing power reduced over time by inflation. For example, did you know that when inflation is running at around 2% per year, it takes about 36 years to cut your purchasing power in half?

Or put differently, a million dollars today may only buy half that amount of today’s goods or services in less than two generations when inflation is present. Taken together, the important point here is that at each phase of the wealth management process there are risks that could prevent you from building enduring wealth.

Protect Your Wealth Today

So, what steps can you take to protect your hard-earned wealth today? Well, one way to prepare for life’s unexpected events is to incorporate a disciplined risk management process into your wealth management framework. Let’s take a look at some examples of how this risk management process applies as we create, grow, and preserve financial wealth.

Risk Management: Creating Wealth

Events that hamper your ability to use your innate talents to produce income and generate savings are key risks during the wealth creation process. One way to protect your wealth during this time is to utilize insurance as a tool to protect against financial loss.

The key to preserving your wealth during this time is ensuring you have the right amount of insurance coverage to meet every one of your financial needs. For example, COVID-19 has reminded us all of our mortality. At the same time, it has served as an important reminder that life insurance can be a useful way to create financial wealth.

This is especially true if you experience unexpected tragedy in your own life before you’ve had a chance to build the kind of wealth that will leave your loved ones protected. In a similar vein, now’s also the time to take a look at your disability coverage. More specifically, you should consider whether the limits on your disability insurance policy are sufficient to cover your living expenses should you become injured and can no longer work.

The point here is that if your goal is to build enduring wealth, you will need a method to defray some of the risks as life’s curveballs threaten to take you out of the game. In our case, insurance provides a way to defray some unknown risks and immediately creates a financial source of wealth in case of an unexpected tragedy.

Risk Management: Growing Wealth

Fees and taxes are factors that can hinder your ability to quickly build enduring wealth during the growing wealth process. Your goal during the growth process should be to maximize your risk-to-reward ratio. And one way to do this is to reduce unnecessary investment fees.

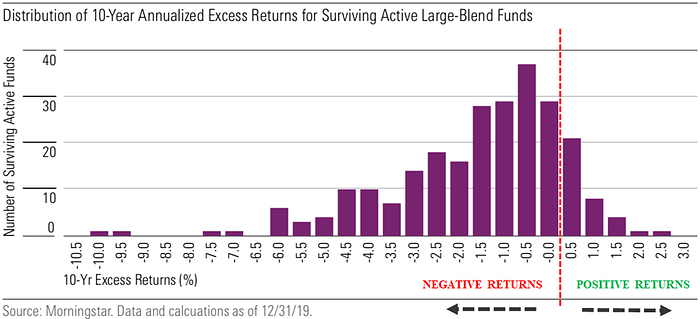

For instance, actively managed investment funds tend to charge a premium when compared to passive funds. Therefore, now’s a good time to look at the performance of these funds and consider whether what you’re paying for active management is worth the additional cost. This is notably important at a time when active managers in some cases have underperformed their passive benchmarks.

Addressing unnecessary taxes is another way to cut your losses during the growing wealth process. This is especially true if your investments produce income and you’re not yet retired.

For example, you can minimize the taxes that you pay by making sure that income producing investments are held in tax deferred vehicle like a 401(k) or IRA rather than a taxable brokerage account.

Risk Management: Preserving Wealth

If you are planning on taking distributions from your retirement within the next year or expect to leave a legacy, protecting wealth at this phase is important now more than ever. You’ve put in the hard work to grow your money, so now’s a critical time to protect it as you move from accumulating wealth to distributing wealth.

We mentioned earlier how a sudden drop in markets can derail even the best-laid retirement plans. That’s why you’ll want to have a distribution strategy in place that addresses how retirement assets will be liquidated during periods of heightened market volatility.

For example, giving more distribution weight to an asset that is less sensitive to sharp moves in the markets and ensuring you have an adequate level of cash on hand to weather volatility is one way to prepare for such times. When it comes to leaving a lasting legacy, having a solid estate plan is where it all starts.

Also, you’ll want to make sure that your long-term investment management process reflects the realities of inflation. Remember, purchasing power can be cut in half in less than two generations when inflation is running at around 2% per year.

With government debt issuance ballooning by $3 trillion and Federal Reserve assets growing at an exponential rate, you’ll want to make sure that how your legacy assets are managed align with today’s inflation expectations. This is important because doing so will help ensure that your wealth can adequately serve generations now and into the future.

Protecting Wealth Begins with a Process

The coronavirus certainly has exposed our varying levels of financial risk preparedness. Even so, we believe that you can take some especially important take steps right now to protect your wealth, starting with being risk-aware.

This means identifying the kinds of threats that may crop up at various life phases and then preparing for those threats as part of a disciplined risk management process. There’s no doubt that when it comes to building enduring wealth it’s important to think about the steps you need to take today to create and grow your money over the long term.

However, another important step is taking the time to protect yourself against the threats that are waiting to separate you from your hard-earned wealth. Some of these steps include utilizing tools like insurance, tax and cost-efficient investing vehicles, and a solid investment, estate, and distribution plan to protect your money.

Finally, be sure to manage risks for the long term. This involves continuously evaluating the current economic and market environment to identify evolving threats to your wealth. Then use some of the tools that we’ve discussed to help mitigate those risks.

We believe that incorporating an active risk management process into your wealth management framework could ensure that your wealth endures for the long-term no matter what surprises life throws your way.